Activity & Growth Financing for Self-Actuating Communities

From Permissionless Capital to Purposeful Growth

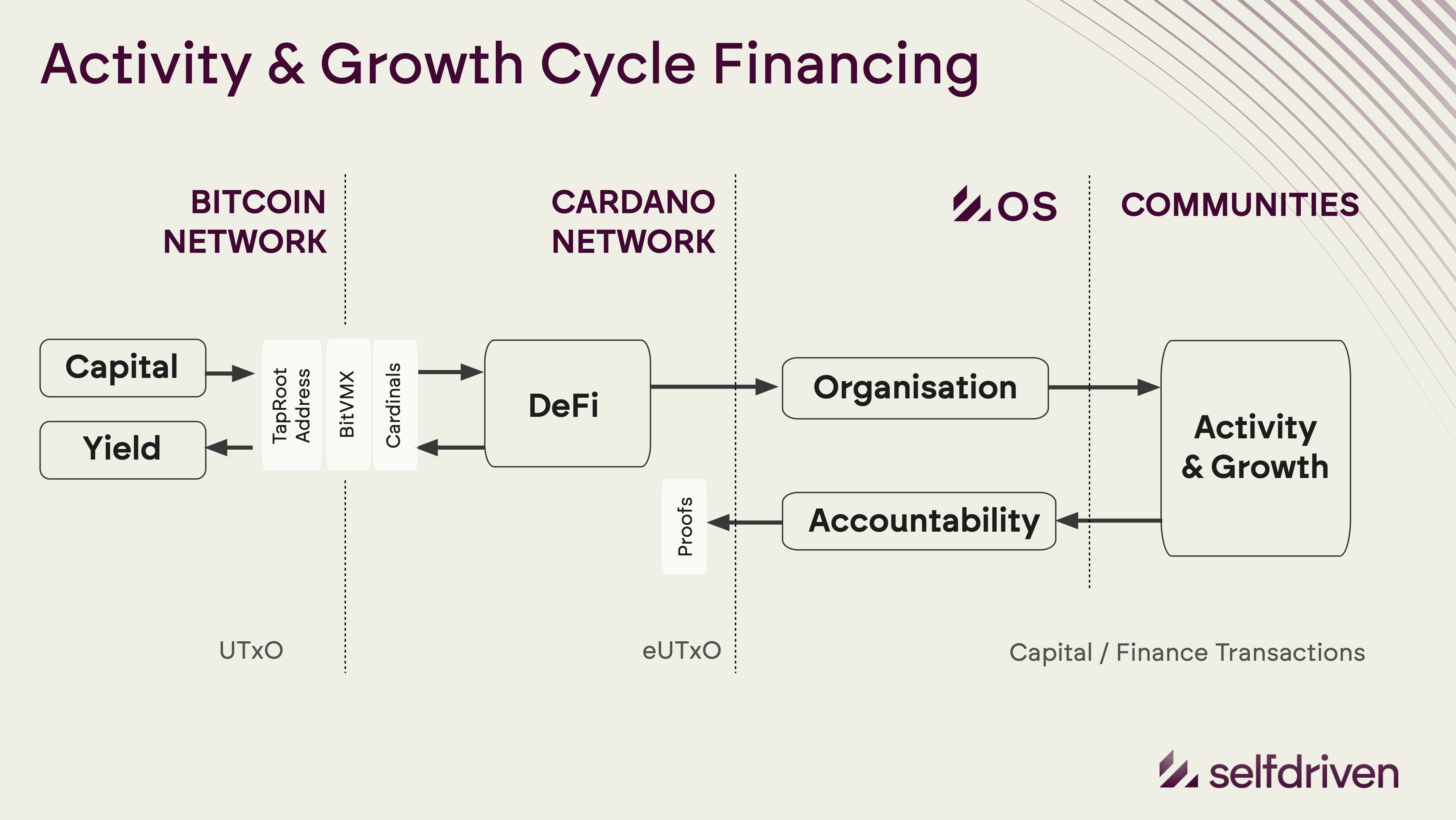

selfdriven.finance connects Bitcoin (permissionless capital) and Cardano (permissionless DeFi) to power community-driven growth.

It channels long-term crypto capital into local, purpose-aligned initiatives — turning yield into impact.

1. Bitcoin Network → Permissionless Capital

Bitcoin holders form the foundation.

By depositing BTC into Taproot addresses, they make their capital productive through BitVMX and Cardinals protocols.

This converts idle BTC into collateral — enabling stable, interest-bearing lending and liquidity while preserving decentralisation.

Flow:

- Bitcoin Holder → Taproot Address → Collateral Pool

- Collateral backs DeFi loans and stable assets (e.g. USDM)

- BTC remains verifiable and auditable on-chain

2. Cardano Network → Permissionless DeFi

Cardano provides the programmable finance layer.

Here, collateralised BTC supports USDM (provable, USD-backed 1:1) and related stablecoins.

These assets power:

- Lending pools (P2P or perpetual)

- Interest-bearing loans

- Automated liquidation (via on-chain lending protocols)

The Cardano extended UTxO model ensures every transaction is deterministic, auditable, and composable.

If thresholds drop, collateral is sold, and bad debt is recorded on-chain — protecting solvency and preserving community reputation.

3. selfdrivenOS → Coordination & Trust

The selfdrivenOS layer (Organisational System) links financial flows to human trust systems.

It governs:

- Allocation of funds (who gets what and why)

- Voting, reputation & decision tracking

- Interest & threshold maintenance

- Identity verification via Verifiable Credentials

selfdrivenOS ensures that community organisations and facilitators can coordinate transparently — embedding governance directly into the financing cycle.

Every allocation, conversation, and decision builds verifiable trust.

4. Communities → Activity & Growth

Funds flow into Community Organisations that drive real-world change:

projects, education, health, sustainability, local enterprise, and more.

Facilitating organisations support this process by guiding:

- Project setup & governance

- Marketing & awareness

- Collaboration & skill sharing

Each completed project strengthens the community’s credibility and access to future capital.

5. Accountability & Feedback Loop

The cycle completes through accountability proofs.

When projects generate outcomes:

- Interest is paid to lenders

- Collateral is released to Bitcoin holders

- Results are verified and recorded on-chain

If a default occurs:

- Collateral is liquidated

- USDM debt is covered

- The Bad Debt Register maintains integrity across lending pools

This creates a self-correcting loop — aligning finance, governance, and reputation.

Outcome: Regenerative Finance

Each cycle of selfdriven.finance strengthens two networks:

- Bitcoin Network: Stores and secures capital

- Cardano Network: Executes programmable, verifiable community finance

Together, they create a regenerative economic engine — where every transaction reinforces community resilience.

Bitcoin provides the roots.

Cardano grows the branches.

Communities bear the fruit.