Protecting Capital and Preserving Trust for Self-Actuating Communities

When communities borrow, capital must remain safe — even when markets shift.

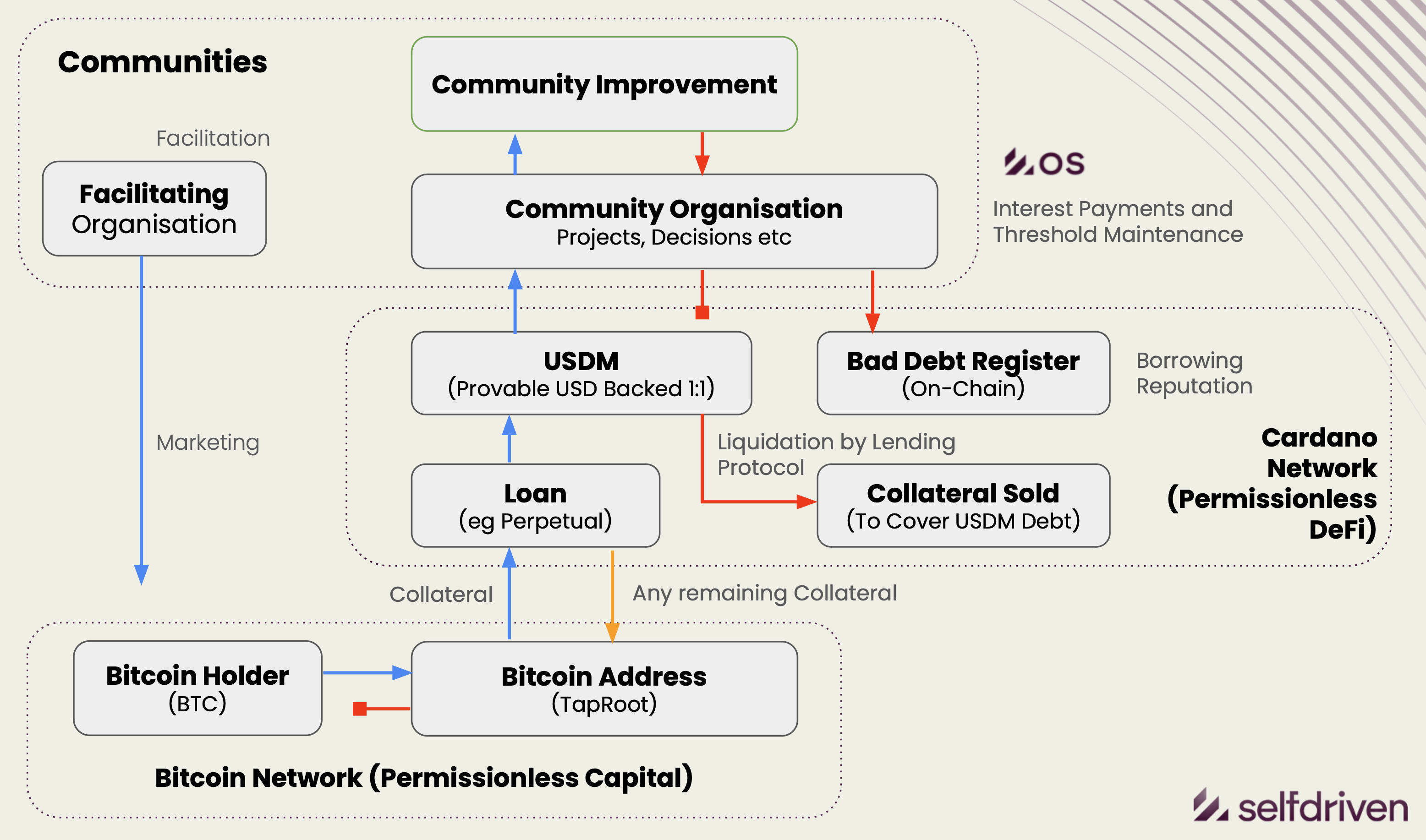

The selfdriven.finance liquidation flow ensures that both Bitcoin collateral and Cardano-based loans remain provable, redeemable, and reputationally sound.

1. The Starting Point — Collateralised Bitcoin

Bitcoin holders deposit BTC into Taproot addresses, which serve as verifiable collateral vaults.

These addresses can be linked via BitVMX or similar bridging logic to the Cardano DeFi layer, enabling capital to back stable assets such as USDM.

Collateral remains provably owned by the depositor while being productive within lending pools.

2. Loan Creation — USD-Backed Stability

On the Cardano network, the collateral enables issuance of USDM (or alike), a provable, USD-backed stable asset.

Loans can be structured as:

- Pooled lending (shared liquidity pools)

- Peer-to-peer agreements

- Perpetual or term-based positions

Borrowers — typically Community Organisations — use these funds for projects under selfdrivenOS governance (education, health, local enterprise, sustainability, etc.).

3. Risk and Interest Management

selfdrivenOS provides oversight of repayment schedules, thresholds, and interest flows.

It continuously monitors key metrics such as:

- Collateralisation ratio

- Repayment performance

- Borrowing reputation

Communities that consistently repay maintain or improve their credit thresholds — gaining access to larger pools and better terms.

4. Liquidation Pathway — When Collateral Falls

If collateral value drops or repayment fails, the DeFi protocol triggers automated liquidation.

Flow:

- Collateral is flagged by the lending protocol.

- A portion is sold to cover the outstanding USDM debt.

- Any remaining collateral is returned to the BTC holder.

- The debt record is added to the Bad Debt Register (on-chain).

This ensures every lending position is transparently resolved and no systemic debt accumulates unseen.

5. The Bad Debt Register — On-Chain Accountability

The Bad Debt Register operates as a public, immutable record of liquidations and defaults.

It is accessible by selfdrivenOS lenders, and community facilitators to inform governance and risk decisions.

A transparent debt ledger strengthens long-term credibility — making good standing a tangible, on-chain asset.

Borrowing reputation (positive or negative) then influences future access to capital across the network.

6. Threshold Maintenance & Reputation Recovery

Through selfdrivenOS, communities can restore their borrowing reputation by:

- Repaying outstanding interest

- Reinvesting in community improvements

- Meeting defined governance thresholds

This regenerative approach transforms liquidation from punishment into learning and recalibration.

7. Network Synergy — Bitcoin, Cardano, and selfdrivenOS

Each network contributes distinct resilience layers:

| Layer | Role | Trust Mechanism |

|---|---|---|

| Bitcoin Network | Collateral & Capital Source | Taproot proofs |

| Cardano Network | DeFi Logic & Settlement | eUTxO transactions |

| selfdrivenOS Layer | Governance, Tracking, Identity | Verifiable Credentials |

| Communities | Borrowers & Implementers | Reputation & Proof-of-Impact |

Together they form a multi-chain accountability architecture — uniting immutable collateral with transparent social proof.

Outcome: Financial Integrity with Human Oversight**

By combining DeFi automation with selfdrivenOS governance, selfdriven.finance achieves a rare balance — trustless capital, yet trusted communities.

Collateral builds confidence. Liquidation maintains integrity. Reputation drives regeneration.